Announcement on Tax Refund for Overseas Visitors Shopping in China

To further enrich market supply and expand inbound consumption in our province, in accordance with the Announcement of the Ministry of Finance on Implementing Tax Refund Policy for Overseas Visitors Shopping in China (Ministry of Finance Announcement No. 3, 2015) and the Notice on Further Optimizing Tax Refund Policy to Boost Inbound Consumption (Notice SXFF No. 84, 2025) issued by the Ministry of Commerce and five other central commissions and departments, Jilin Province will implement the tax refund policy for overseas visitors shopping in China from September 1, 2025 according to relevant regulations. The relevant matters are hereby announced as follows:

I. Tax Refund Policy

Tax Refund for Overseas Visitors refers to the policy of refunding value-added tax (VAT) on goods purchased by overseas visitors from designated tax-free stores upon their departure from China.

(1)Overseas Visitors refers to foreign nationals and compatriots from China's Hong Kong, Macao, and Taiwan regions who do not stay in Mainland of China for more than 183 consecutive days.

(2)Refund articles refer to personal items purchased by overseas visitors themselves at tax-free stores that meet refund conditions, excluding: Items listed in the Prohibited and Restricted Items for Exit and Entry of the People's Republic of China; Items sold in tax-free stores that are eligible for VAT exemption policies, and other items designated by the Ministry of Finance, the General Administration of Customs and the State Taxation Administration.

(3)Same-store single-day purchase amount reaches or exceeds RMB¥ 200; Goods are unused and unconsumed; Departure occurs within 90 days after purchase; All purchased goods are to be carried or checked in personally upon departure.

(4)For articles subject to 13% VAT rate: Refund rate is 11% (including agency service fees); For articles subject to 9% VAT rate: Refund rate is 8% (including agency service fees).

II. Tax Refund Procedures

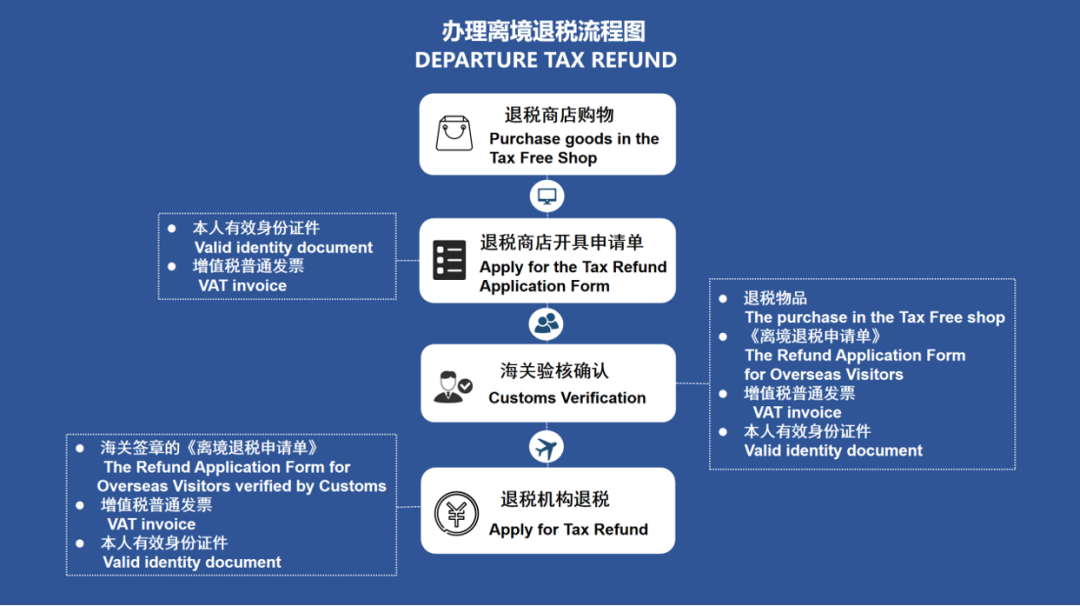

(1)Tax Refund Procedures

1. Purchase goods in the tax-free store;

2.Apply to the tax-free store for the Tax Refund Application Form;

3. Customs Verification;

4. Tax Refund Agency Processing.

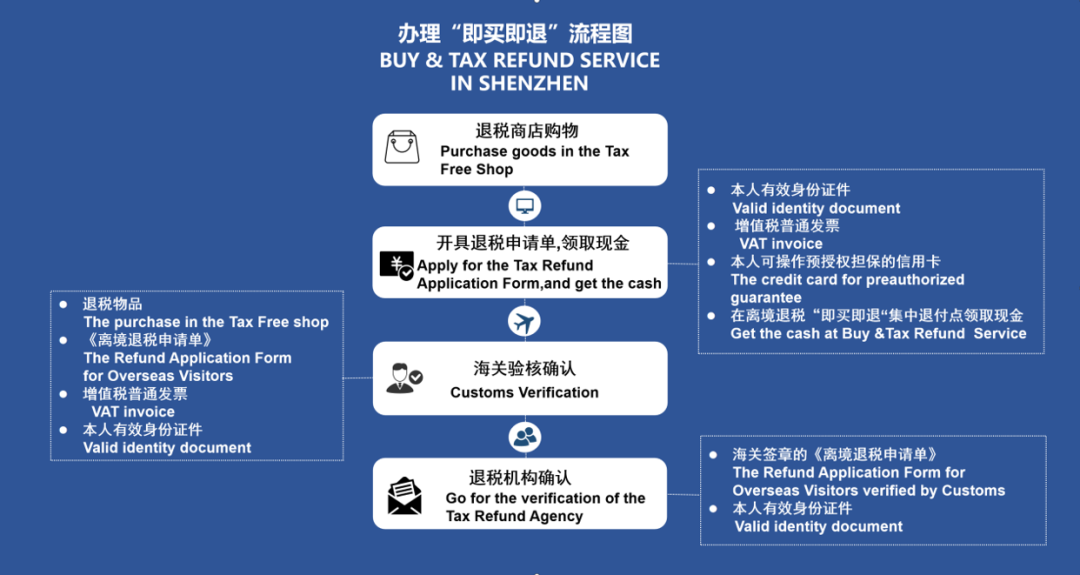

(2) Procedures for Tax Refund “Instant Tax Refund upon Purchase”

1. Purchase goods in the tax-free store;

2. Overseas customers apply to the tax-free store for the Tax Refund Application Form, and get the cash;

3.Customs Verification;

4.Go for the verification of the Tax Refund Agency.

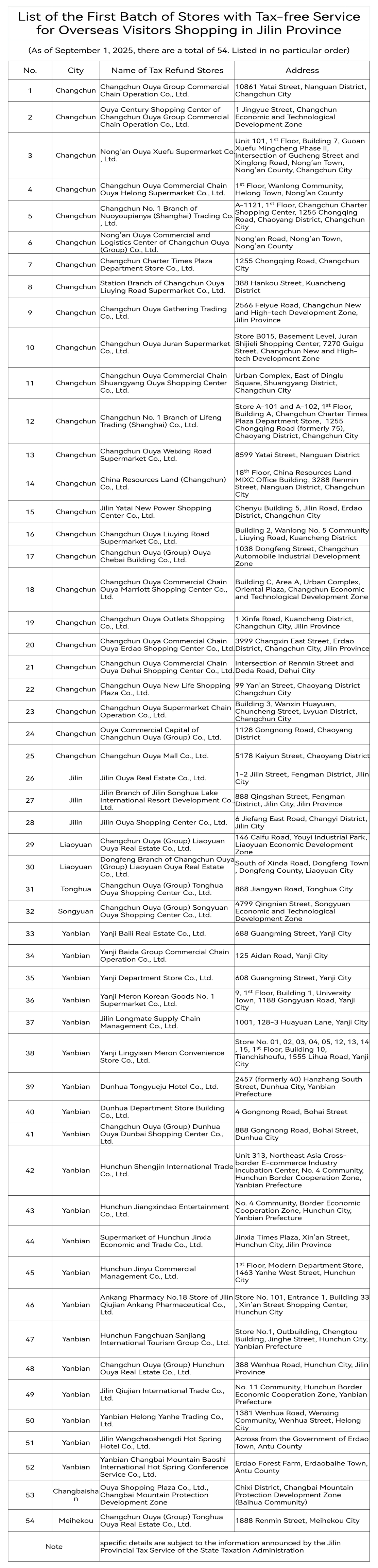

Ⅲ. Tax-Free Stores

As of September 1, 2025, our province has opened 54 tax-free stores (specific details are subject to the information announced by the Jilin Provincial Tax Service of the State Taxation Administration). Please refer to the table below for details.

IV. Tax Refund Ports

Three tax refund service ports are now available: Changchun Longjia International Airport, Yanji Chaoyangchuan International Airport and Hunchun Port. Currently, Yanji Chaoyangchuan International Airport is temporarily closed and unable to provide tax refund services for overseas visitors.

(1) Changchun Longjia International Airport

1. Address: 3500 Jichang Road, Jiutai District, Changchun City, Jilin Province

2. Tax Refund Office: West side opposite to Gate 3 in the restricted area of Terminal T1, Changchun Longjia International Airport

(2). Hunchun Port

1. Address: 230th meter east of the Russian Commodity City, Hunchun City, Yanbian Prefecture, Jilin Province

2. Tax Refund Office: Departure Hall of the Passenger Inspection Building, Hunchun Port

(3). Yanji Chaoyangchuan International Airport (Temporarily Closed)

V. Tax Refund Agency

Jilin Provincial Branch of Bank of China

VI. Related Matters

(1) Jilin Province will further increase the number of tax-free stores and centralized points for "instant refund upon purchase", and optimize its tax refund services. Specific details will be adjusted and announced dynamically.

(2) Matters not covered in this announcement shall be handled in accordance with the the Announcement of the Ministry of Finance on Implementing Tax Refund Policy for Overseas Visitors Shopping in China (Ministry of Finance Announcement No. 3, 2015), the Notice on Further Optimizing Tax Refund Policy to Boost Inbound Consumption (Notice SXFF No. 84, 2025) issued by the Ministry of Commerce and five other central commissions and departments, and other relevant regulations.

This announcement takes effect from the date of issuance.

Attachments:

1. Guide to Tax Refund for Overseas Visitors

2. Q&A Handbook for Tax Refund for Overseas Visitors

………………………………………………………

初审:高勇 复审:陈会泽 终审:吕继伟